{{mpg_address}}

| IFSC Code | {{mpg_ifsc}} |

| Bank | {{mpg_bank}} |

| Branch | {{mpg_branch}} |

| City | {{mpg_city}} |

| District | {{mpg_district}} |

| State | {{mpg_state}} |

| Address | {{mpg_address}} |

| Micr Code | {{mpg_micr_code}} |

What is IFSC code?

The Indian Financial System Code (IFSC), is a unique 11-digit code that is used for online transactions made through NEFT, RTGS and IMPS. You can find the IFSC code on the check page provided by the bank. The Reserve Bank of India (RBI) provides IFSC bank codes. In addition to the check sheet, you can also find the IFSC code on the official website of the bank and the RBI.

In the event that you use net banking to transfer money, it is imperative that IFSC be submitted to initiate the transfer. Unless there is a merger, banks do not change or change the IFSC code.

IFSC Code: Other Key Features

- It helps to identify a particular bank branch separately

- It helps eliminate errors in the transfer process

- It is used for all electronic payment options such as NEFT, RTGS and IMPS

Differences Between IFSC Bank Code and IFSC Credit Card

In the case of IFSC bank code, it varies from branch to branch. However, the IFSC credit card code of a particular bank will remain the same nationwide.

IFSC credit card code of other banks is set out in the table below:

| Bank | IFSC |

| HDFC Bank | HDFC0000128 |

| Citibank | CITI0000003 |

| Axis Bank | UTIB0000400 |

| HSBC Bank | HSBC0400002 |

| Punjab National Bank | PUNB0112000 |

| IDBI Bank | IBKL0NEFT01 |

| Yes Bank | YESB0CMSNOC |

| IndusInd Bank | INDB0000018 |

| State Bank of India | SBIN00CARDS |

MICR Code: Magnetic Ink Character Recognition Code

Magnetic Ink Character Recognition (MICR) is a 9-digit code that helps to identify a specific bank branch that is part of the Electronic Clearing System (ECS) used to clear checks normally. This code can be found on the check sheet issued by the bank and is usually printed on the passcode provided by the account holder.

In the nine digits, the first three digits indicate a particular city, the next three digits indicate a particular bank code and the last three digits represent the bank branch code. For example the MICR code of the SBI branch in Kolkata is ‘700002021. Here, the first 3 digits ‘700’ are used to identify a particular city, the next three digits ‘002’ represent a particular bank code and the last three digits ‘021’ specify a bank branch code. The MICR code is used for processing and deleting checks, which are automated. The 9-digit code helps eliminate errors in the removal process, helps speed up the process and makes processing checks safer and more secure.

Bank IFSC Code Format:

| A | B | C | D | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|---|---|---|

| Code for Bank Name | 0 | Code for Branch Name | ||||||||

What is MICR Code?

Magnetic Ink Character Recognition (MICR) is a 9-digit code that helps to identify a specific bank branch that is part of the Electronic Clearing System (ECS). This code is located on the checkbook issued by the bank and is usually printed in the logbook provided by the account holder.

The main purpose of the MICR code is to erase computer-generated checks. The code helps to avoid mistakes again.

MICR code format

The first three digits of the code represent the city, the next three digits represent the bank code, and the last three digits represent the bank branch code. For example, the MICR code of the SBI branch in Kolkata is ‘700002021’. Here, ‘700 ‘represents the city, ‘002’ represents the bank, and ‘021 ‘represents the bank branch.

Check IFSC Code for Top Banks:

| State Bank of India IFSC Code | HDFC Bank IFSC Code | Indian Bank IFSC Code |

| Axis bank IFSC Code | Canara bank IFSC Code | ICICI Bank IFSC Code |

IFSC Code Search: Bank Branch

IFSC codes are the basic basis for any online banking transfer in India and a secure firefighting mechanism to verify all transactions. With the proper knowledge of IFSC codes, sending and receiving money online becomes easier and faster, as intended.

Many resources are available online that help you get the IFSC code of the particular bank you requested. And let’s face it – you might be looking at the same thing when it comes to online transactions. In the same vein, jaavak provides a complete tool to help you get into a quick and accurate search of the IFSC Code.

The step-by-step procedure for conducting IFSC code search at jaavak.com is given below:

- You are already on this page as you read these instructions, scroll to the top of this page.

- Spreading before you is a simple ‘IFSC Code and MICR Code Guidelines’, a tool that can help you find the IFSC Code as needed. The tool has the following fields- 1) Select Bank, 2) Select Country, 3) Select Region, and 4) Select Branch.

- Kindly make the right choices regarding the name of the bank, the country of India where there is a bank branch, a certain state of the state and finally, a concerned branch.

- To answer your question, a successful page lists IFSC bank list, MICR Code, official address and phone number. All of this happens in less than 30 seconds from your first question.

IFSC Code: How It Works

Let’s take the example of the Canara Bank IFSC code to better understand what the IFSC code is and how it applies to bank sales. The IFSC code for Chandigarh’s Canara Bank branch is CNRB00001995.

- Here, CNBR stands for the name of the bank, which is Canara Bank

- The 5th letter, 0, is for future use

- Another 6 letters, 01995, directly assist the RBI to identify the bank branch without error.

Now, let’s understand how IFSC works. When transferring funds to a specific fund, the person must provide the account number and code of the IFSC branch. Once the sender has provided this information, the money is sent to the account holder and IFSC helps to avoid any errors in the transaction.

In addition to the transfer of funds, the IFSC code can also be used to purchase insurance and associated funds through net banking. The Reserve Bank of India’s (RBI) National Clearing Cell monitors all transactions and IFSC code helps the RBI keep track of transactions and also make fund transfers without error.

IFSC code can also be found in your checkbook or bank passport. One can also find their IFSC bank branch code in the monthly account statement. The IFSC code for each bank and branch is different.

Importance of India Financial System Code

We need the IFSC code because it helps the RBI to monitor all banking activities without errors. A simple IFSC code can help track RBI, oversee, and securely secure all financial transactions performed by NEFT, RTGS and IMPS.

For bank customers, the IFSC code is important because most electronic wallet transfers cannot be initiated unless the IFSC code of the beneficiary / payer is provided with the bank account number.

IFSC code plays an important role in transferring money from one account to another using methods such as IMPS, NEFT and RTGS. All of these options are primarily concerned with the transfer of funds between banks but this function is done in different ways. A common thread between these various options is the IFSC banking code system.

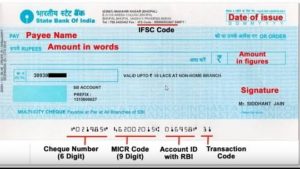

Locate IFSC and MICR Code on a Bank Cheque

Many of the above discussions have focused on routine bank assessments. This pillar of the world of banks is a combination of many things that help to ensure that they are true and allow us to attach our full faith to its operation.

The main features of a standard bank check are shown as follows:

Obtain IFSC code from Check Bank:

In standard bank checks, it is mandatory that the IFSC code be listed. IFSC code will vary from bank to bank. In our example image: we show the location of the IFSC code in the HDFC Check.

Finding a Check Number:

Shown in typed font below the check in special font style. This is used to track check and other administrative purposes.

Get the MICR Code from Check Bank:

This is shown next to the check number. Both the Check numbers and the MICR Code are displayed in a unique ink font, the last of which can only be taken by Magnetic Character Ink Reader.

The methods used to transfer money over the Internet are using IFSC code

IFSC code can be used to transfer funds using three electronic transfer methods such as NEFT, RTGS and IMPS. These electronic wallet transfers enable customers to transfer money easily from one account to another.

Choosing electronic transfer systems reduces the chances of a transaction error because the transfer of funds is authorised only if accurate details such as IFSC bank payment code and bank account number are provided.

- NEFT: The full form of NEFT is National Electronic Fund Transfer. As the name implies, it affects the transfer of funds from one bank account to another. This is a popular money transfer system in India. Here, IFSC codes must be properly provided to ensure that money is transferred securely from one bank account to another. In addition to IFSC code, beneficiary name, account number and account type are required to be provided. All NEFT tasks are solved in an intelligent batch format.

- RTGS: RTGS is a Real Time Gross Settlement dictionary. As the name suggests, it is a popular way to transfer money quickly (as well as securely) from one bank to another, without having to set the same for any waiting period. The terms used here are ‘Real Time’ (transaction is fast) and ‘Gross’ (referring to the fact that no additional charges will be charged). IFSC codes do the same in the case of NEFT – which helps to better identify participating banking branches. RTGS fund transfers are often used for high-value transactions and are quickly removed. The information required for the RTGS fund is the name of the payer, the IFSC code, the account number, and the transaction amount.

- IMPS: IMPS, short for Fast Payment Service, is very popular. It is a new trend in India (launched in November 2010). With this service, money can be transferred instantly to all popular banks in India through a service available from a registrar, ATM or online. This program is known for its high security, speed, savings and is not limited to the highest transfer fees. One cannot initiate the transfer of an IMPS fund without providing the IFSC code.

IFSC and MICR Code: Basic Differences You Should Know

Given the table below the differences between IFSC Code and MICR Code:

| IFSC Code | MICR Code |

| IFSC is a 11-digit alphanumeric number. | MICR is a 9-digit code. |

| IFSC is used to facilitate electronic money transfer between banks that operate in the country. | MICR is used to make cheque processing simpler and faster. |

| In an IFSC code, the first four characters indicate the name of the bank. | In the MICR code, a combination of the fourth, fifth and sixth digit indicate the bank code. |

| In IFSC, the last six characters represent the branch code. | In the MICR code, the last three digits indicate the bank branch code. |

How Can You Transfer Money With IFSC Bank Account Code?

Once a person knows his or her way around banking transactions, they already know that there are two main ways to transfer a wallet. Another old-fashioned way, where you go into a bank and clear a check. While the second is an electronic method that uses methods such as IMPS, NEFT or RTGS.

When working the old-fashioned way of ‘going to the bank’ in an old school, one does not need to register a beneficiary. However, the electronic method is a little different and very secure as well.

To transfer funds with the help of technology, that person is required to meet the requirements set out below:

- One needs to sign up for a net banking service.

- You need to sign up for a third party transaction. (Note that in this context, the third party refers to the beneficiary from a different bank to yours.)

- Register a beneficiary account where the funds will be transferred.

Process Involved In Making Money Transfers Online

Almost all Indian banks follow their own policy regarding third party money transfers. One thing to note here is that the process is almost always the same, except that they are written differently.

For example, let’s look at the HDFC Bank process. The steps involved are:

- Sign in to a network banking service with a customer ID and password.

- Click on the ‘Third Transfer’ tab and follow the basic instructions.

- Obtaining OTP from a registered mobile number once the details have been completed and sent.

How to Register a Beneficiary Account?

- Beneficiary registration, details such as beneficiary name, account number, IFSC bank beneficiary code, and branch name of the Bank must be provided.

- Once the details have been submitted, the registration is complete. However, different banks have different times after which you can transfer for the first time. For example, in the case of HDFC Bank, it takes 12 hours for the data to be processed and processed.

How Can You Transfer Money With the Help of Net Banking & Mobile Banking?

Electronic transfer of funds with the help of IFSC code is an easy process once established. The process of transferring money via net banking and mobile banking is described below:

Via Net-banking:

The whole bank transfer process is given below:

- Visit the official website of the bank.

- Go to the net banking site.

- Sign in with user help and password.

- Next, select ‘Transfer funds via NEFT’ to transfer the amount to the recipient’s account. In the unlikely event that the beneficiary is not heard, that person must register for the upcoming transaction. To do this, IFSC code, bank account number, and branch bank must be provided. Once the information has been successfully submitted, it can take anywhere between 5 minutes and 12 hours, depending on your bank policy for the beneficiary’s account to be activated. After waiting for the specified hours, the money can be transferred immediately to the beneficiary’s account with a buffer for less than an hour.

With Mobile Banking:

Here’s how to transfer money from one bank account to another using IFSC code using advanced banking:

- The first thing a person needs to do is to register a 10-digit mobile banking number by linking it to a bank account. To register, that person is required to complete a form after which a start-up kit containing MMID (a unique 7-digit number) and mPin is provided. This kit is similar to the one one gets with a bank card.

- After registration is complete, sending money via SMS is easy. First, that person needs to select ‘IMPS’. Next, each person needs to provide the beneficiary account number, IFSC code, and the amount they want to send. After confirming the transaction, that person is required to type mPin. By doing so, the money is successfully transferred from the account to the beneficiary’s account.

What is a UPI (Unified Payments Interface)

Basically the new payment structure introduced by the Reserve Bank of India under the leadership of former Raghuram Rajan and the support of tech scion Nandan Nilekani. In short, the UPI is said to be the next generation payment method that is expected to harness the growing power of smart phone technology and the equal increase in smart phone users in the country. It enables you to make money transactions between any two bank accounts with the help of a smart phone. While the UPI payment system allows for online and offline payments, such as net banks and swipe cards, it is much more complex and complex at the same time.

Frequently Asked Questions on IFSC and MICR codes

- What is the full IFSC form?

- Answer: The full IFSC form is the Indian financial plan code.

- Why is IFSC used?

- Ans: IFSC or Indian Financial System Code is an 11-digit code used to distinguish all bank branches within the National Electronic Funds Transfer (NEFT) network by the Reserve Bank of India.

- How can you search for a bank name with IFSC code?

- Ans: It is very easy to get a bank name using IFSC code. The first four letters of the IFSC code represent the name of the bank. Therefore, if the bank name is ICICI, the IFSC code will look like ICIC0001420.

- What is the meaning of the MICR code?

Ans: MICR stands for Magnetic Ink Character Character Recognition. It is a special ink that is sensitive to magnetic field. Printed at the bottom of the check.

- What is the use of the MICR code?

Ans: MICR is a technology that helps ensure the start of checks or other paper documents. It is mainly used by banks to process checks quickly. The MICR code assists the RBI in locating a bank branch.

- How can I transfer money from one bank account to another online?

Ans: You can transfer money from one bank account to another using online mode using methods such as National Electronic Fund Transfer (NEFT), Real-time Gross Settlement (RTGS), Payment Service (IMPS), and Unified Payment Interface (UPI).

- Are IFSC and SWIFT code the same?

Answer: No, IFSC and SWIFT codes are not the same. IFSC is used to transfer funds within India, while the SWIFT code is used to transfer funds at the international level. In addition, SWIFT is a banking identification code while IFSC is used to identify a specific branch of a bank.

- If the bank branch is converted, will the IFSC code change?

Answer: No, if the bank branch location is changed, the IFSC code will not change. If a bank account is transferred from one bank to another, only then will the IFSC code be changed.

- Is the IFSC code the same as the branch code?

Answer: No, the IFSC code does not match the branch code.

- Where can the IFSC code be found in a check sheet?

Answer: IFSC code is usually located in the upper part of all check sheets on or near the bank branch address.

- Is IFSC code required in IMPS?

Ans: IFSC code is required for IMPS only if a person transfers money using a bank account number. If MMID recipient is not available, they will need to add a recipient as a payer, where details such as bank account number, name and IFSC are required.

- Where can I find the MICR code check?

Ans: The MICR code is printed on the lower part of all check sheets provided by banks.

- Is IFSC code different?

Answer: Yes, IFSC code is a unique alphanumeric code.

- Is it possible to determine the IFSC code of a bank branch from the bank account deposit number held at the same bank?

Answer: No, this is not possible as the 15-digit long-term savings bank account number does not include the IFSC bank code.

- I think I gave the wrong IFSC code when I started the NEFT transfer. What will happen to my money?

Answer: There is no need to panic as NEFT transactions will pass and benefit the intended recipient, you need to provide the final account number and the corresponding IFSC bank code. In the event that you provide the wrong IFSC code, the system has a name against the recipient name and account number to identify the error and refund. Refunds will be highlighted in your account within a few hours.

- Can I get the IFSC code in my bank passbook?

Answer: Yes, you can access the IFSC code in the bank book. As directed by the Reserve Bank of India, banks must print IFSC and MICR codes prominently on checkbooks, account statements and checks issued by them.

Other IFSC Related Article

| NEFT | RTGS | UPI |

| IMPS | BHIM | AEPS |

| NEFT Timing | Digital Wallet | Mobile Wallet |

| SBI UPI |

[+] All Bank IFSC Code Click Here

Taxi Booking Chet

Taxi Booking Chet